Introduction

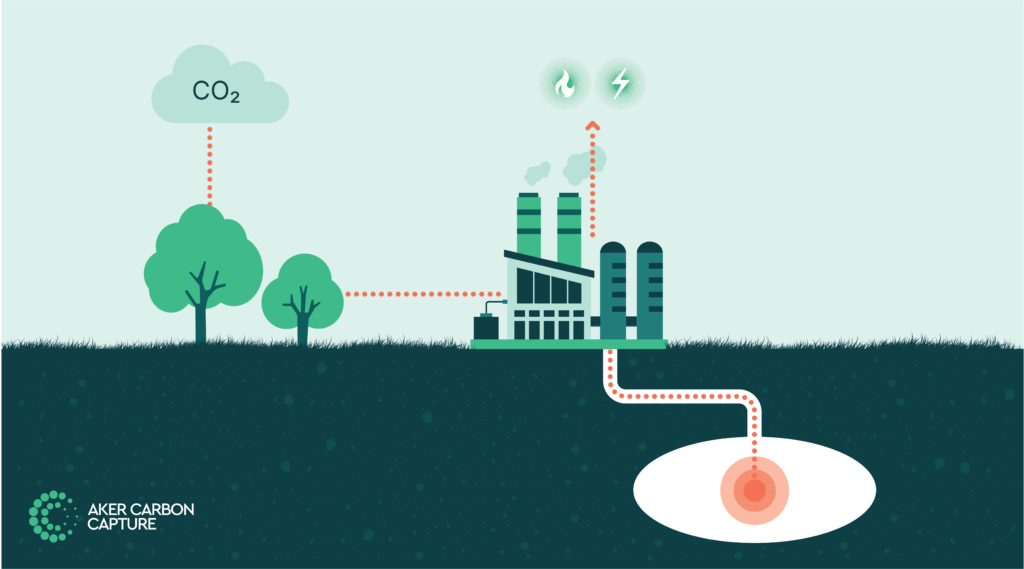

As the world grapples with the urgent need to combat climate change, while being continuously reminded of our rapid approach to 2030 climate commitments, innovative business models and progressive policy incentives are emerging to reduce greenhouse gas emissions. Among these, bioenergy with carbon capture and storage (BECCS): using biomass for energy production while capturing and storing the resulting CO2. Otherwise known as permanent carbon removal, industrial carbon removal value chains are key to achieving carbon neutrality objectives enshrined in several national climate laws, however, incentives and policy provisions need to recognize the potential of facilities generating negative emissions and ensure a transparent and coherent framework to facilitate these projects.

Background

So far, 2024 has been an unprecedented year with several strong policy developments, especially in the EU with its Industrial Carbon Management strategy, proposed 2040 climate reduction targets of 90% compared to 1990 levels, with a strong emphasis on carbon capture, and a provisional agreement on the Net Zero Industry Act which is widely known for its 50 MTPA CO2 injection capacity target by 2030.

In the UK, the first Track-1 projects are expected to take their Financial Investment Decisions (FID) this year pending final negotiations between relevant projects and authorities. This will ultimately cater for CCS through a cluster sequencing approach to develop 4 industrial clusters by 2030 (Track 1: HyNET and the East Coast Cluster; Track 2: Acorn and Viking). These negotiations build on continuous funding business model developments over the last few years within Dispatchable Power (DPA); industrial Carbon Capture, including specific subsection for EfW (ICC); bioenergy with CCS (BECCS) and Greenhouse Gas Removals (GGR) which are all different in nature and technicalities. The outcome of the negotiations will result in many important ‘lessons learned’ for the next wave of projects and therefore we are at a particularly pivotal stage in the CCS development timeline with a precedent being set as we speak.

How to accelerate CCS and CDR timelines

Parts of the industry find themselves in a precarious position today with a highly intertwined value chain consisting of private actors and public authorities. Since many emerging projects are subject to and dependent on government funding, while also serving the greater purpose of inherently contributing to the nation’s climate obligations, developers and authorities are often presented with uncertainty and risk as they are embarking on these first-of-a-kind projects.

The Energy from Waste (EfW) sector is in a unique position as the incineration of municipal and industrial waste produces both fossil and biogenic CO2 emissions. The fraction of fossil vs biogenic CO2 in the flue gas stream from an EfW plant depends on the feedstock being incinerated, but in most municipal waste incineration facilities, it is typically around 50/50. If this CO2 is captured and stored, the fossil CO2 released from the incineration of waste can be abated, while capture of the biogenic CO2 emissions results in carbon dioxide removal, meaning that CO2 is removed from the atmosphere and the natural carbon cycle. The real challenge is how to account for the biogenic vs fossil contents of the captured CO2 – this will naturally be a significant part of credit creation, but also a determining factor if the fossil contents are tied into a carbon tax or emissions trading scheme.

A multitude of large private corporations have the same, if not more aggressive internal climate mitigation ambitions and are therefore finding ways of contributing to the financing of BECCS projects through off-taker agreements for high-integrity carbon removal credits. It is crucial to allow these investments to contribute in harmony with relevant government support schemes that are also helping finance the first projects to be economically viable. This was a significant enabler in the major Ørsted Kalundborg Hub BECCS project that Aker Carbon Capture was awarded in May 2023, which for the customer will deliver over 430,000 tonnes of high-integrity carbon removal credits. A significant amount of these credits will be purchased by Microsoft over more than ten years to contribute to its commitments of being carbon negative in 2030 and removing its historical emissions by 2050.

Conclusion

The first initial projects will provide a blueprint to guide the industry as it grows and transitions away from government financing. The current active policy provisions and continuous development is what needs to instill enough confidence and predictability in emitters that are looking for solutions to reduce their carbon dioxide emissions. What really matters now is that the first wave of projects cross the finish-line and are implemented successfully, such as those in the UK Track-1 process, and that the industry, policymakers, and other stakeholders extract valuable lessons learned for what enabled these projects to move ahead to accommodate future opportunities, for instance with the build-out of scalable transport and storage infrastructure that future emitters can tie into. In the grand scheme of things, knowledge-sharing and transparent cooperation between countries should be encouraged as the challenges we all face are not limited to borders and we need to work together to find common solutions.